Productivity Driven Agency Management Systems Vs Feature Driven

For years and years there's only been one type of agency management system written... the feature driven system.

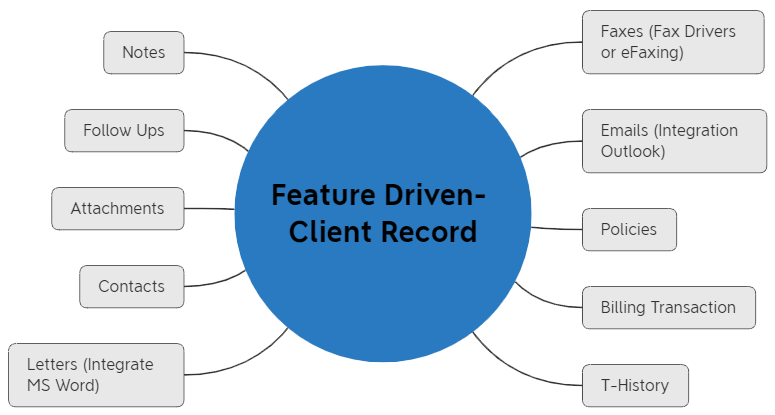

For the vendors it was always all about the features. It goes something like this... "We need notes, we need follow ups, we need attachments," and the vendor with their team start listing out all of the features they need to add.

Features are the foundation to this system.

A typical design would look like this...

It's listing all of the features and then making sure they're added to the system.

Of course there's some basic integration which needed to be done also.

This is why a feature driven system including accounting can get written and released in 1 to 1 1/2 years. It's just a matter of plugging in the features to the client record.

Almost all also start with just personal line policies. A few have included commercial lines but just the basics to say they offered it. Consistently we hear how weak these systems are in managing commercial lines clients.

Getting a system out onto the market under 2 years is pretty dang impressive. No wonder there's so many systems to choose from now days. At my last count there were 24.

But consistently they have a lot of double entry, are weak in commercial lines and they don't do much to increase the efficiency or productivity in an agency. I know because I've worked on a number of these systems and have talked to agencies on these systems.

Designing A Productivity Driven System

My First Management System.

My first experience with insurance automation was when I wrote a database program for my agency in the mid 1980's. It was a very simple database which included:

- Client database with their name, address and phone #.

- I added a "class" field with a pull-down field to choose Customer, Prospect, Suspect, Lead or Dead. This allowed me to filter records for reports, letters and grid queries.

- Linked a policy database to the clients to track what policies they purchased. It just captured the main policy fields and not the coverages.

- It tracked premiums and commissions allowing us to use the system to pay out commissions to the producers.

- It had a report module where I created all kinds of reports.

- It had a letter writer which merged data from the databases into the letter allowing me to write personalized letters.

I learned "relational" databases very quickly, and fell in love with the efficiency an automation system offered our agency!

I share more about this part of my history else where. Let's move on.

Since 1989 when I went into consulting working with agencies on their marketing and automation I had one objective and outcome where automation was concerned... to increase the agencies productivity allowing them to do more work in less time to spend more time on marketing and bringing on new clients.

By 1992, helping agencies increase their productivity became my full-time role, and because nothing can do more to help an agency increase its productivity than the right automation I became an expert in agency automation and agency management systems. For 30 years increased productivity has been my focus, and likewise, what I strived hard to master!

As I worked on different management systems it became very obvious management systems were not created equal. Oh sure, they all had client databases, notes, follow ups and so forth, but between...

- Their design,

- How you maneuvered through the system,

- How many windows you had to go through to do your job, and

- How much double entry there was...

...they were very different. These are the top differences, there are more.

For years I made recommendations to different vendors on how to make their management system more productive. Unfortunately, the most common response I got was, "Our table structures won't support that suggestion."

It became very clear how important the table structures are.

Designing & Having CP Manager Written.

Key point...

When building a productivity driven system the approach is completely different.

Rather than listing all of the features needed you instead map out the workflow steps for handling policy tasks and all of the actions/steps involved in the task.

Take handling an endorsement, for example. You list out the steps to process the endorsement to include the different options. For example, the workflow and process is different if you're downloading with the carrier versus not downloading, or whether you have binding authority or not. These differences need to be addressed.

For each step in the workflow you're listing the feature needed and how it will be used (very important). By understanding how it's used as part of workflow it allows you to re-engineer this feature to create a more fluent and productive solution.

The point is, blue-printing a productivity driven system is based upon how an agency would use the system step by step, policy task by policy task (ie, Renewal, Endorsement, Cancellation, Claim, etc.) and what work agency staff need to stay on top of so things don't slip through their fingers.

A productivity system is all about how an agency would actually use the system, not on what features they need. Features are added to a productivity system based upon their being needed to support a workflow or task.

I spent 1 1/2 years blue-printing CP Manager alone. This was 12 hour days 6 days, sometimes 7 days a week. It was a massive job!

You wouldn't believe everything I did to create the blueprints to include using a database program to strategize table structures. This is because I learned very quickly as a consultant the importance of table structures, and I knew that once you started adding clients to the system you have to lock down your table structures.

By the time I was done I had mapped out the flow of data in the system to eliminate almost all double entry creating one of the most single-entry systems on the market, and I had created a system built around how you do your work to create a more efficient, more productive and a more insurance specific system. This in part means less steps, less windows and less data-entry.

This isn't all. When designing CP Manager it was all based upon workflows and how work is processed creating a more intuitive and common-sense workflow. Considering all of the systems on the market are feature driven and not workflow or productivity based, there was no model to follow.

With no examples or models to follow this made the task of blue-printing and having CP Manager written that much more difficult and time-consuming. However, I was blessed to have had over 25 years of agency experience helping agencies to be as productive as they could, and having a strong background in both agency automation and in writing database programs.

I could never have achieved what I did with CP Manager if I hadn't had my programming background. It's true, table structures are everything... they're the key to how data flows and how you design the system!

Designing and having the system written based upon workflows and how a person actually uses the system created another challenge... programmers are not taught to write software this way! They're taught to create "feature driven" systems forcing me to work extremely closely with the programming team and micro-managing them because I was also changing their approach to programming. (By the way, the programming teams all said learning what I taught them on how to write more productive software programs was the #1 thing they appreciated by working with me.)

In the end, to create the results I was after I ended up:

... and we did a lot of other things with the focus on increased productivity. (Just wait until you see what we did with Notes, Follow Ups, Attachments, Correspondence, etc... it's mind-blowing!)

There were a lot of examples of how to add these features to the system, but none of these features in other systems were designed for a productivity driven system. This is why I ended up re-engineering all of these features... to support the productivity driven system.

Agencies call CP Manager the "most insurance specific systems they've ever experienced".

It took over 8 years to write CP Manager, plus the 1 1/2 years of blue-printing. Using it and seeing how intuitive and fluent it is, experiencing how single-entry it is and how everything flows so smoothly, and seeing everything you can do with minimal keystrokes, I smile from ear to ear.

It's feature rich, that's for sure, but more importantly it's extremely productive. We clearly achieved what I was after when designing and having CP Manager written.

I'm very proud of CP Manager.

CP Manager is advancing the agency management system from being feature driven to finally being productivity and workflow driven. This advancement is long overdue!

The creation of CP Manager is the biggest re-engineering and overhaul of the agency management since they went from accounting based to client/policy driven in the 1980's.

What's frustrating about this is the insurance industry has always been workflow driven and we've had client based agency automation since the early 80's, but building a system based upon workflows took 40 years with CP Manager being the first.

Since the last big change in management systems in the 1980's the only big changes have been going from DOS to windows (this didn't change their design, it only changed the operating environment), then from windows to browser based (again, this didn't change their design, it only changed the operating environment).

I believe you will be very impressed when you have a walk-through of it.

If you want to learn more about the process to get CP Manager written, and want to learn more about the design of management systems you can request an informational piece I wrote called, "Agency Management Systems Are Not Created Equal". In case you're curious, I also address why no other vendor has been able to create a productivity driven system.

Schedule a Walk-Through now and experience CP Manager yourself.