Agencies are excited about how efficient, single-entry and powerful CP Manager is with Commercial Lines, especially at our price point.

Over the years this was one of my top frustrations with management systems… how they handle commercial lines clients & policies. It shouldn’t be surprising…

I Designed CP Manager To Be A Commercial Lines Powerhouse!

(At the bottom of this page you can sign up to see a webinar replay for a webinar we did showing how powerful, efficient and easy to use CP Manager is when handling commercial lines clients and policies)

For years I’ve criticized management systems for their inability to properly manage commercial lines policies. This has been an ongoing problem over the years and is still a problem today. It’s because of this I’ve watched many agencies over the years pay the huge price for AfW, 360, TAM and Epic because of how weak the lower priced systems have been in the area of commercial lines management.

We all know how much more complex commercial lines is over personal lines, and it is. Managing commercial lines is a beast compared to personal lines which is why there are so few management systems which handle it properly and why the very high majority of the systems available are predominately personal lines driven.

Effectively supporting the commercial lines agency goes way beyond just offering commercial lines applications. It’s starts with understanding the “structure” of a commercial lines policy with the foundation to this being how the sections are tied to a policy.

It’s about realizing a package policies with multiple sections is the norm for a commercial lines agency. This is foundational, and just the beginning of the differences between managing personal lines policies and commercial lines policies.

The problem other vendors have faced is trying to take a personal lines driven system which is built based upon a mono-line policy and then building the table structures and functionality to effectively manage commercial lines because it would require a complete re-write and overhaul of policies and how they’re handled. Because of this they try to make the commercial lines policy conform to their personal lines driven system, and there lies the beginning of a huge problem.

I knew the complexities of commercial lines upfront, and I knew commercial lines policy management was a much more complex project so we started with commercial lines.

Our table structures have been built for the commercial lines package policy and all of the uniqueness’s of the commercial policy. Like I stated early, personal lines policy management is easy. It’s putting in place the table structures and functionality to support commercial lines policies that’s the far bigger, more difficult job.

This is in part because the commercial lines policy is based upon a one-to-many table structure (many sections to a policy) where a mono-line (one section) personal lines policy is based upon a one-to-one table structure which is far easier to handle. The problem arises when you build a system based upon a mono-line policy table structure and then try to build in the ability to handle many sections to a policy which is common in commercial lines.

With Commercial Lines There Is More Of Everything

With commercial lines there are more drivers, more vehicles, more premises, more contacts, more additional interest, more coverages… there’s more of everything!

Trying to capture all of the data for a commercial lines policy and then having a system that handles all of this data in the most single-entry way possible is not an easy task, especially if you’re trying to incorporate commercial lines management into a personal lines driven system. I can’t emphasize enough how the table structures to manage a commercial lines policy is so significantly different than a personal lines policy.

A personal lines system planning for just 6 vehicles will be enough for 98% of the policies you write. For commercial lines this doesn’t even begin to be enough.

For a personal lines policy the high majority are mono-line policies so having a system that only supports mono-line policies will work for 99% of the policies you write where the majority of commercial policies have more than one section creating a package policy. If the system doesn’t handle multiple sections properly it will be a time consuming, clumsy and inefficient system for commercial lines that will steal your time when working with commercial lines policies.

In addition, we made sure the main client record supported the commercial lines client.

The posture we took on all tables that captured data was that our system needed to support the agency with 1,000 users and when entering data into the applications we designed it to handle 10,000+ of those items. This could be drivers, vehicles, locations, Schedule of Hazards, Additional Interest (AI/Cert Holders), etc.

By taking this posture and designing our system this way we’ll be able to support the largest agency including agencies with large national contracts that has hundreds of locations, and thousands of vehicles and drivers, etc.

Let’s take a look at some of the things we’ve done to support the commercial lines policy and client.

Here’s How The CP Manager Supports Commercial Lines Clients

From here forward I’m going to share with you some of the things we’ve done to make CP Manager a Commercial Lines Powerhouse. I’m not going to share everything here because there are some things that are an exclusive feature of the CP Manager. When you have a walk-through of the CP Manager your account manager will cover those exclusive features of CP Manager along with the other things I don’t share here.

The Client Record

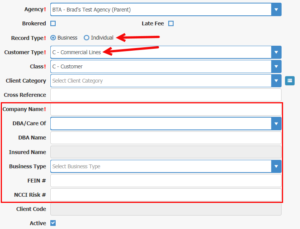

When adding a new record there are a number of fields that are specifically for a business clients…

- First, if you primarily enter in commercial lines accounts at your staff record you would set the default for new clients you add as “Business”, “Commercial Lines”. You also set the default for the Class field. The first field you’ll need to fill out is the Company Name field.

- We separate individual personal lines records from business commercial lines accounts. That’s because there are very distinct differences between a personal lines account and a commercial business account and this field puts those things into motion.

- In our system you cannot put a personal lines policy with a commercial lines account or visa versa. This is a strategic design because of their differences to make data-entry easier and so you can properly manage your commercial accounts, and run reports on for both PL & CL accounts. However, you control which policies are personal lines and which are commercial lines. Farm, for example, is considered a personal lines policy with some agencies and a commercial lines policy with other agencies. You determine which it is for your agency.

- To further support only putting personal lines policies with an “Individual” client and commercial lines policies with a “Business” client, we give you the ability to link client’s together and then to combine their policies for reporting purposes. Plus, by linking them together you can quickly jump between the linked records. Make sure to have your account manager show you this because it’s quite impressive what we’ve done here.

- We capture the Company Name, DBA/Care Of and business type which flow to policies.

- We capture unlimited contacts. They become a lookup for contact fields on the applications.

- You can attach notes to a contact record (also shows up at the main client record) and you can tie correspondence to a contact (also show up at main client record). This allows you to see the notes and correspondence specifically for this contact and other contacts.

- And speaking of contacts, you can add officers of the company, key contacts of the company and even advisers to the company like their attorney or CPA. Then to categorize them you just select their relationship to the client from a Lookup Table you control.

- You can search for a client record by company name or DBA/Care Of, the two main business name fields for a commercial record. Of course we offer way more ways than this to search for a client record. I’m just pointing out the business specific fields.

- I’m aware that many of the systems do not let you search for contacts of a client. With the CP Manager you can search for a specific contact by first name, last name, phone #, email address or by the insured name. And then when you find the contact you can either open up the contact record or jump straight to the main client record for that contact. You will seriously love this feature which has solved a huge problem inherent with so many of the systems.

Then to make things even easier for you, we give you access to the following items right from the client record:

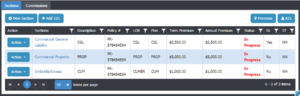

- You have policies at your fingertips. However, not only can you see the main policy information, you can also see the sections to the policy. For example, you can see the LOB, Plan Code and section premium. On the policy line you can see the policy premium of all sections combined together. You have a lot of information at your fingertips without needing to pull up the full policy details. (See image above, click for larger view of it.) To open the policy to view the details, just double click on it (partial image of it below).

- The producers, CSR and carrier are hyperlinks that open up their records (also available on the client record). This saves time when a client calls you and needs contact information for the carrier, producer or CSR, or if you need to jump to one of these records to contact them about this client.

- You have Drivers, Vehicles, AI’s, Locations and ANI’s right on the main client screen. This means you have Drivers License #’s, vehicle VIN #’s and much more right at your fingertips without having to even open up the policy. You’re going to love the convenience this offers and the time it’ll save you.

- You can also jump right to the Policy or the ACORD form from these items.

- One of the reasons we have AI’s on the main client record is clients don’t always need or want the AI’s as part of the policy. By placing them here you have a spot to place them that’s tied to the client record and you can still pull them into a master certificate to issue them a Certificate Of Insurance.

There’s more, but this should give you a good idea of what we’ve done to support the commercial lines agency. Agencies I’ve had conversations with and have shared this information with have all been extremely impressed. Like they are telling us, “You have a very clear understanding of the needs of a commercial lines agency,” and we do!

The Commercial Lines Policy

When it came to policy management we were forced to re-engineered the policy to create the kind of functionality and ease-of-use agencies have been wanting for a long time.

In the process of re-engineering the policy we paid very close attention to the table structures. The advantage we had here is we knew what we were after in the long run, not just the short run, so we were able to design our table structures to support the direction we’re going with our policies and the many additional features we’re planning to put in place over time.

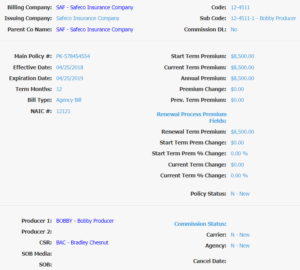

The following 2 images is just a partial picture of the policy page showing the lower section. It doesn’t show the top with all of the buttons including the 1 click Policy Task buttons or the side with all of the functionality available down the left side of the window. However, the image still shows a lot of information about the policy.

Since our focus in this article is about commercial lines policies specifically I’m not going to discuss the very strategic design here and the additional fields we’ve added to the policy to improve your reporting, accounting, help with renewals and the overall functionality of a policy. We’ll get into that discussion when you have a walk-through of the system.

I do want to point out, however, that when it comes to filling out the section application you work right off the ACORD form. A huge complaint of a lot of CSR’s and especially producers over the years when working with a system that doesn’t work off an ACORD form is all of the windows and tabs they have to go through to just fill out the fields which merge to the ACORD forms. The high majority of people find the ACORD form much easier to work with, fill out and find information. It’s also a lot faster, and the learning curve is greatly reduced!

Commercial lines policies are built based upon sections. In the image above you can see the sections in the 2nd image. Adding, viewing, editing or endorsing a section is just a click away.

In addition, when you add a section you can quickly see if that section is downloaded or not. This lets you know whether you need to enter full policy information or just the header information and let the download populate the policy data.

Remember, our focus is on increased productivity so this feature takes the guess work out of populating the policy detail and lets you know when you need to manually enter it and when it’ll be populated automatically via downloading.

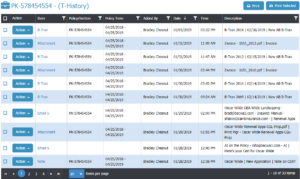

Another thing we did was create a complete and accurate history of the policy as it’s endorsed and as other changes are made to the policy. Even if you remove or add a driver or vehicle via an endorsement it’ll create a historical policy that you can reference if you ever need to. To access a policy’s history you click the “Policy History” button at the top of the screen.

What you’ll love about our history is you can go back to a historical policy and view it just like it was written on that date. Very few systems can do this.

You can also see all policy specific T-History. You just click T-History under the Service Tools down the left sidebar…

You can sort them by the column headers, filter the list by any of the columns and jump to any of the items by clicking the hyperlink to it (item field). You can see:

- When the Policy was added.

- Attachments

- Billing Transactions

- Master Certificates for this policy

- Notes

- Follow Ups

- Email Sent including to Cert Holders

- Phone Messages

You have all of this information in one place with a hyperlink to the item.

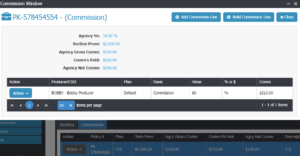

Commissions

Commissions are also strategically built at the section level. Each section maintains the commissions for that section. Following we see the commission detail for the first section, the Commercial General Liability Section (CGL).

Notice how it allows you to create commissions for unlimited producers to include CSR’s. It just can’t be greater than the agency’s commissions.

With commissions being maintained at the section level the accuracy of paying out commissions on a commercial package will be a whole lot more accurate. This information will then flow into a Billing Transaction which we call a “B-Tran” where it sets in motion producer payables, carrier payables and more.

As you can see from this image we capture a lot of information about your commissions to include what the agency makes on each section after paying out commissions. Commission reports will be a whole lot more accurate and you’ll know how much money your agency has made a lot quicker and easier.

Just so you know, you can turn off someone’s ability to see the agency commissions or the commissions of anyone other than their own. This is handled at Security Templates.

Because our focus here is on commercial policies I’m barely scratching the surface of everything our accounting does even at the policy level. This will be discussed when you have a walk-through of the system. Just remember, we had one of the top insurance specific accounting experts in the industry design our accounting system. You will not be disappointed!

Certificates Of Insurance

Certificates of insurance are a big deal to the commercial lines agency. I have a client that I worked with that had 7,000 certificates she had to put out each November. Certificates handled wrong that doesn’t take advantage of today’s technology, or that is designed wrong, can be a huge job that would frustrate any commercial lines agency that has a lot of certificates to put out.

We quickly solved a lot of problems where Certificates are concerned. Let me just give you a bullet list of some of the things we did.

- Building a Master Certificate is a breeze. It integrates with the clients policies and pulls the information from them into the certificate saving you time.

- If there’s an endorsement to the policy that needs to be reflected at the Certificate, updating the Master is again a breeze… just click END from the Action Button on the Master Certificate.

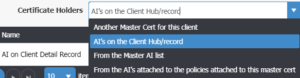

- Managing certificate holders is done very eloquently. You can pull in the AI’s on the policy, the AI’s listed at the client record, pull from the Master AI list, or pull all of the Cert Holders from another Master Cert. See the image following.

- It’s very common for a Cert Holder to need a cert, but they don’t need to be added to the policy which would increase the premium. This is why we created the ability to add AI’s to the client record. You’ll like how we did this.

- Each AI has a field that tells the system how they’re to receive their certificate. It’s the Correspond By field where you can choose Email, Fax or Letter for printing them. Once you’ve finished creating the master certificate and have tied the AI’s to the Master Certificate you just select “Build Email/Fax” from the Action Button and those that are to be emailed are emailed, those that are to be faxed are faxed and those that are to be printed and mailed are printed. Boom. Done!

- Each AI can have it’s own personalized wording that’s printed on the Certificate.

- You can attach items to the AI that will be included when that AI’s Certificate is processed.

- You can also add an attachment to the Master Cert which will be sent to all AI’s.

Nice, isn’t it?

And of course if a Cert Holder says they didn’t get theirs you can easily pull up their record and just re-send it.

Whether you process thousands of certificates at the same time or one or two at a time, you’ll truly love how the CP Manager handles certificates.

While I haven’t covered everything, I’m sure you’ll agree we handle certificates exceptionally well. Our Certificate of Insurance management will put an end to the time-consuming task of getting certificates out. My only question to you is, “What will you do with all of your free time?”

Commercial Lines Management Like You’ve Been Wishing For…

Overall, pretty impressive isn’t it?

Of course I’ve only scratched the surface of how CP Manager will turn your commercial client & policy management headaches into an efficient process. This is why you’ll want to get a walk-through of the CP Manager… to see everything else we’ve done to make your life a whole lot easier and to give you back your time.

We’re proud of what we’ve put together. You’ll be proud to own the CP Manager and excited about all of the time it’ll save you and how much faster you’ll be able to service your clients and get your work done.

We’re looking forward to walking you through this amazing system.

CP Manager, A Commercial Lines Powerhouse Webinar Replay

Recently we did a webinar showing the commercial lines features, commercial client management and commercial policy management. We received numerous emails from participants of how impressed they were with how we designed CP Manager to handle commercial lines so well… easy, thorough, single-entry.

To watch the video replay fill out the following form. A link to the URL for the video replay will be emailed to the email address you enter on the form.

PO Box 13405

Spokane Valley, WA 99213

Phone: 208-242-4321

Fax: 509-368-7325

info@AgencyATeam.com

www.AgencyAutomationTeam.com

Isn’t it time you got your time back?

Isn’t it time you got your time back?

Now you can with CP Manager!

Schedule your Walk-Through Now and See For Yourself What a Highly Productive System Can Do For Your Agency!