Meme-Windows Based Systems-Can't Log In From Home

Click on image to see full size.

Click on image to see full size.

Choosing an agency management system is one of the most important business decisions you’ll make.

After decades of helping agencies through this process, I can tell you there are smart, effective ways to evaluate a system—and there are poor approaches that almost guarantee a bad decision.

The Importance of a Walk-Through

Let’s be blunt: sales reps often exaggerate what their system can do. Some even stretch the truth.

Example: One vendor advertises “downloading.” But in reality, it only drops a text file into the policy—it doesn’t update the policy. That forces staff to manually update records, which defeats the purpose of downloading altogether.

If you simply ask, “Does your system offer downloading?” the salesperson will say “yes.” Without a walk-through, you won’t realize the feature is nearly useless until it’s too late.

The solution: Insist on seeing the system in action. During a walk-through, have the rep show you exactly how to:

Pay attention to the steps, clicks, and workflow. How much jumping around does it require? How streamlined is the process?

🔑 Bottom line: A product should sell itself when you see it in action. Without a walk-through, you can’t make a fair determination if CP Manager—or any system—is right for your agency.

Next Step: After a walk-through, if you're still not convinced, the natural next step is a Test Drive. This is where you get either a 7-day or 30-day login to CP Manager where you and your staff can dig in and give CP Manager a real test drive and experience it for yourself.

Once you’ve had a walk-through and you’ve seen how the system works, the smartest next step is to get hands-on. Unfortunately, most vendors don’t allow this — they stop at the demo. That’s why I recommend asking if a system offers a test drive. It’s the only way to know if the workflows truly fit your agency. With CP Manager, we make this possible through both a 7-day and a 30-day Test Drive. Few vendors are willing to do that, but it’s the most reliable way to avoid an expensive mistake.

We’re one of the only vendors that offer this:

Learn more about our Test Drive program.

A system’s real cost isn’t the subscription fee—it’s how much time it consumes (or saves) for your staff.

A “cheaper” system that requires 10% more CSR hours will cost your agency far more than you save upfront.

Remember:

Increased Productivity = Increased Profitability.

When evaluating a system, focus on:

📘 Want to dig deeper? Read: What "Increasing Your Productivity" Really Means to Your Agency and The Big Savings with CP Manager.

One of the biggest mistakes agencies make when evaluating a management system is getting distracted by feature lists.

Vendors love to overwhelm prospects with long, impressive catalogs of functions and features. And when they demo the system to agencies, they spend most of the time showing features to "wow" the agency and very little time showing how the system will help them handle their day-to-day work.

But here’s the reality: After talking to many agencies on these bloated systems, most agencies only use 15–20% of those features. Those features they were so impressed with ultimately end up not being used. That's because, when the rubber hits the road, your day-to-day work and increased productivity are what really matter!

This also means they’re paying for a system full of things they don’t use and will likely never need or use.

And worse, all those extra bells and whistles often make the system harder to learn, harder to use, and slower for your staff. Instead of making your team more productive, bloated systems actually create drag.

The real question isn’t “Who has the most features?” The real question is:

👉 “Which system helps my staff get their work done faster and more accurately every single day?”

That’s why the smartest agencies focus on:

Features don’t drive profitability. Productivity does.

An agency that saves 35 hours per CSR per month (a 20% productivity boost) will see a far bigger financial return than one that bought the system with the thickest feature catalog but increase the time for every task.

👉 Remember: Increased productivity equals increased profitability. That’s the true measure of a great system.

We offer multiple ways to review CP Manager—many without ever speaking to an account manager. Some resources require sharing your information first. Why?

Because CP Manager is unique. It was built from over 30 years of industry experience, combining deep workflow knowledge, programming expertise, and an obsession with productivity. No other vendor has invested the time or money we have to create a true productivity-driven system. Protecting these innovations is essential.

When you do speak with an account manager, you’ll find we’re respectful and not pushy. Our goal is simple:

👉 Let's have a discussion and talk about these 3 points. Let's determine if CP Manager is a good fit or isn't the right fit for your agency upfront to save both of us time.

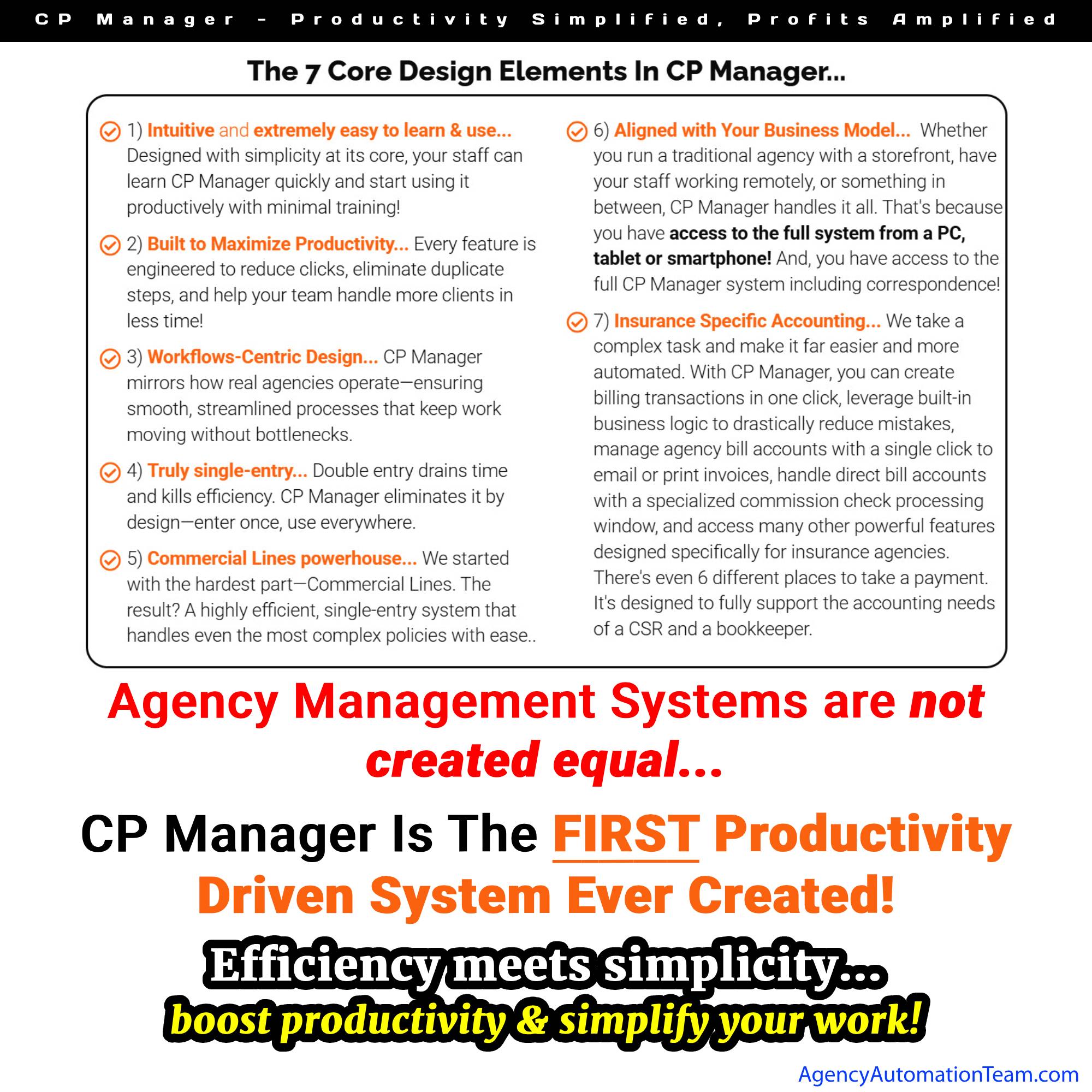

Click on image to see full size.

Every agency owner knows the truth: the CSR is the backbone of the agency.

They’re the ones juggling client calls, processing renewals, handling certificates, managing policy changes, and making sure every detail is accurate. When CSRs are efficient, clients are happier, producers are more productive, and the agency flourishes.

But here’s the problem: most management systems make life harder for CSRs. Clunky workflows, endless clicks, and double-entry create unnecessary stress and steal valuable time.

That’s why we built CP Manager. It’s not just another management system — it’s the productivity engine that unleashes your CSR’s full potential.

Here’s what your CSRs will gain when using the most productive, workflow-driven system on the market:

When your CSRs have a system that works with them instead of against them, something amazing happens:

That leads to happier clients, stronger retention, more cross-selling opportunities, and ultimately — a more profitable agency.

It makes their work easier, faster, and more rewarding — which makes your agency more successful.

Ready to see how CP Manager can transform your CSRs into productivity powerhouses? Schedule a Walk-Through Today!

It’s been a while since we’ve shared an update—and for good reason. We’ve been busy building one of the most advanced and productive agency management systems on the market.

Since our last “Upgrades” article in 2022, over 300 new features and enhancements have been added to CP Manager, including some major upgrades that agencies are already calling game-changing.

One of the unique advantages of CP Manager is that it was designed by an insurance automation consultant with over 30 years of experience. That means the system isn’t just built for “features”—it’s built for productivity, ease-of-use, and flexibility. And yes, that also means the system is constantly being tweaked, refined, and improved. Our President, Bradley Chesnut, is relentless about making CP Manager more powerful and more intuitive—and the results speak for themselves.

From the very beginning, our mission has been clear:

CP Manager was also designed to scale. Whether you’re a small agency or a large firm processing thousands of transactions daily, the system includes powerful search and navigation tools that help staff find exactly what they need, instantly—whether that’s a note, attachment, policy, or client record.

And we’ve proven it. One of our largest agencies, with over 80 users across multiple locations, put CP Manager to the test. Their verdict?

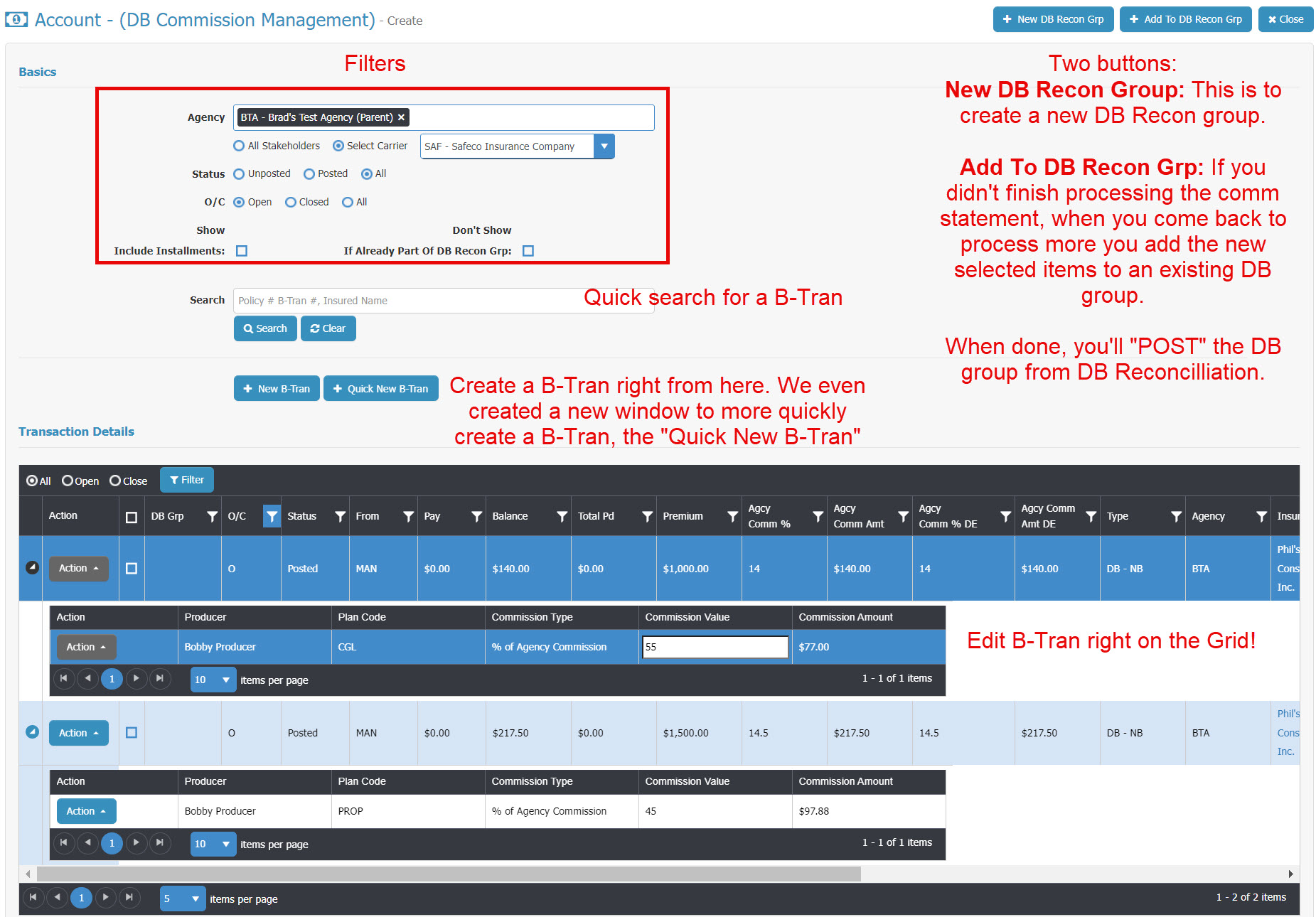

To support their heavy accounting needs, we took CP Manager’s already strong tools and made them even better. For example, direct bill commission statements that used to run 6, 8—even 10 pages—are now reconciled faster than ever, with fewer clicks and smarter workflows. This is because of the first new major enhancement we'll be telling you about.

Our philosophy has always been the same: every second saved is more time your staff can spend serving clients and growing your agency. That’s why every enhancement we roll out is focused on one thing—making your work faster, easier, and more profitable.

Introducing the DB Commission Management feature...

With this new feature we streamlined the DB commission management process dropping the time taking to handle this process by a good 40% with many page commission statements. It's one window where you can do everything needed to reconcile and process your DB commission statements. (Click on images to see it bigger).

This is simply a remarkable new feature.

To enhance this new feature we created a faster way to create B-Trans on the fly...

When you click the button a window pops up to choose the Client & Policy the B-Tran is being attached to. You can either first select the client and then select from that clients policies, or you can just enter the policy number which auto-selects the client...

If you have the policy number, it's just one step to start the process of creating the new Quick B-Tran.

We also give you the ability to select a history policy which is important for audits and doing a B-Tran for the previous policy term. The B-Tran is tied to the policy term.

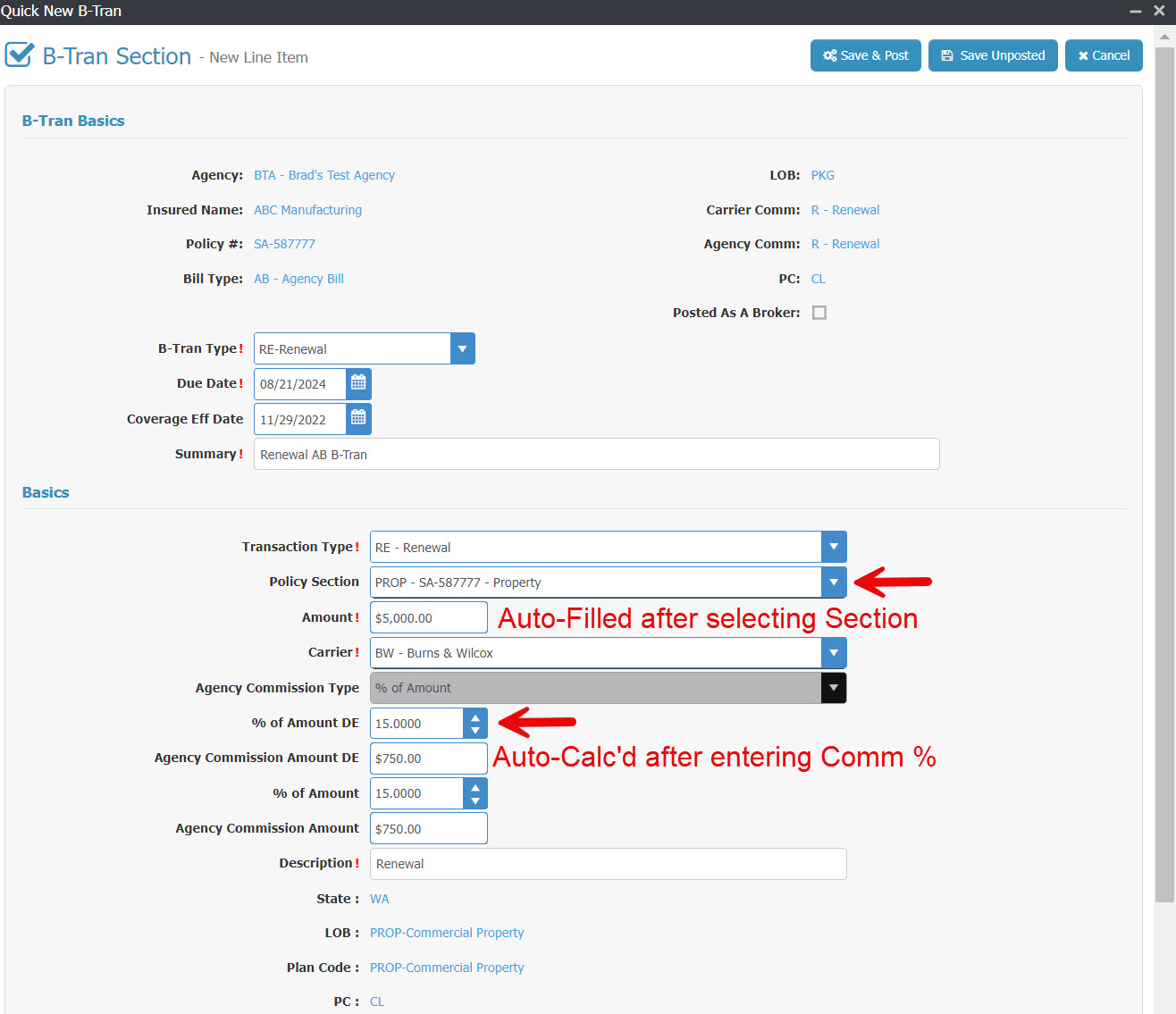

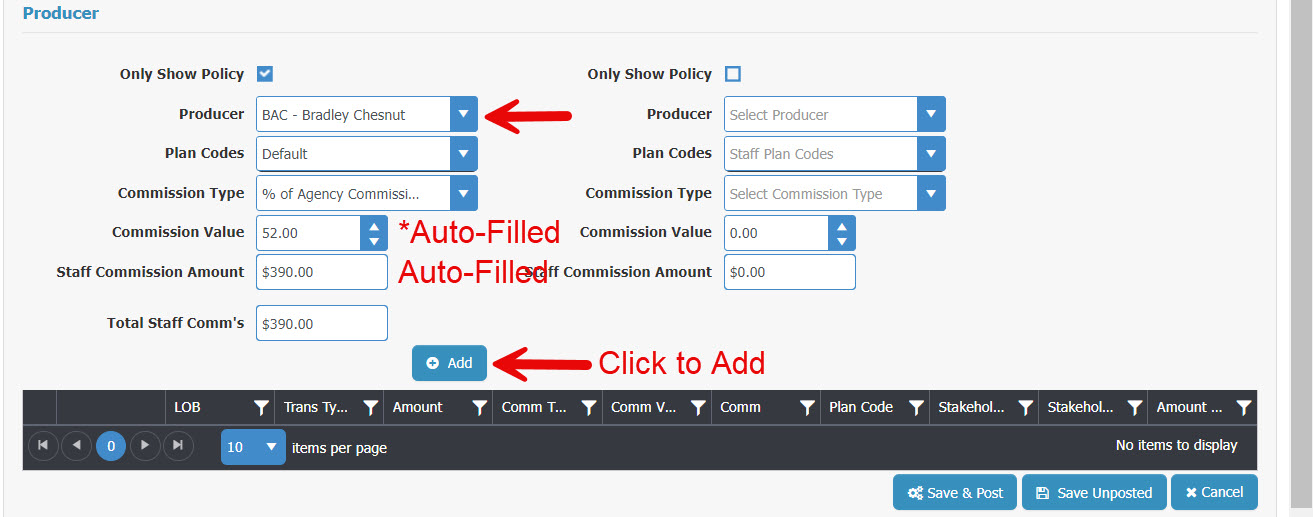

You're then taken to the Quick B-Tran Window... (2 images to show)

In the images, the fields not pointed out auto-fill. You can see which can be edited.

The fields with an arrow pointing to it you'll either select from a pull-down selection window, edit the field or click the button.

The field where we added, "*Auto-Filled" (with asterisk), it's auto-populated when you select the producer with their default commission % but you can override this field.

You can add multiple producers to this B-Tran.

This B-Tran, if Posted, will now show up on the grid to be included in the reconciliation of the commission statement!

The large agency owners and staff are in pure "awe" of these new features!

We also added Commission Downloading which is another major time saving feature in CP Manager. At this point there are now 3 different ways a B-Tran can be created...

To go with Commission Downloading we also include the Commission Download log & a Commission Download Orphan window.

We now offer 3 ways to handle Premium Financed policies...

Each is handled differently in an accounting system so we created routines to support each.

We added a process to handle Producer Chargebacks where the accounting only affects the producer and not the agency. This is very different than a Cancellation where it subtracts the Premium, does an agency commission chargeback and a producer commission charge back.

This special producer chargeback feature only affects the producers commissions!

The last thing I want to share (I find most people don't read huge lists of enhancement updates) is we continued to add more features to increase your productivity and make doing your job easier. Hundreds of little changes throughout the system will allow you to further increase your productivity.

If there's one thing Mr. Chesnut is absolutely 100% committed to, it's helping agencies to have a highly productive and efficient agency!

Check out CP Manager. Believe me, you'll be really glad you did.

The foundation to CP Manager's design was based upon workflows and productivity strategies. This is why it took over 10 years to develop instead of the typical 1-1.5 years for feature driven systems.

When faced with an economy like we are today, nothing will do more to help you survive it than increasing the productivity of your staff! This is because...

Increased productivity equals increased profitability."

Watch video to learn more...

Click the following video to learn more...

Insurance agencies don’t operate in features. They operate in workflows.

Every day is driven by renewals, endorsements, new business, claims, follow-ups, carrier interactions, and work-in-progress that must move forward without slipping.

For decades, agencies have been forced to adapt those workflows to feature-driven management systems — relying on workarounds, memory, and personal processes just to keep work moving.

That mismatch quietly caps productivity.

CP Manager was designed from the opposite starting point.

After decades of working inside agencies and helping them work around the limitations of traditional systems, CP Manager was built as a workflow-driven management system — designed to align the software to how agency work actually flows.

When the system matches the workflow, productivity stops being forced. It becomes an intregal part of the system.

There are two key reasons why it's taken so long...

First...

Programmers are only trained to design feature-driven systems... There is no blueprint or training on how to build a productivity-focused, workflow-driven system.

Second...

Until now, there hasn't been anyone with the key skill sets needed to design one...

While everyone in the industry knew the insurance industry was workflow driven, knowing how to build a workflow productivity-driven system wasn't something they knew how to do.

Instead, vendors created checklists of what an agency management system “needed”—notes, follow-ups, attachments, accounting, etc.—and then set out to plug those features into a client record. This is how pretty much all database programs are created and why they're called "feature-driven".

It’s a straightforward approach, which is why feature-driven systems can often be built and released in just one to two years. Most start with personal lines, sometimes adding a basic version of commercial lines later.

The result?

A system with lots of features on paper, but in practice…

That’s why, despite having more than 30 agency management system options on the market today, many agencies still feel stuck using systems that don’t meaningfully make daily work faster or easier.

The idea behind a productivity-driven agency management system is fundamentally different. Instead of starting with a list of features, you start with workflows—the actual step-by-step processes agency staff perform every day, such as renewals, endorsements, cancellations, and claims.

When building a productivity driven system the approach is completely different.

Rather than listing all of the features needed you instead map out the workflow steps for handling policy tasks and all of the actions/steps involved in the task.

For example, processing an endorsement is very different depending on:

Each of those differences changes the workflow. And each workflow step defines what features are actually needed—and how they should function to be more productive.

This workflow-first approach ensures that every feature exists for a reason: to make the CSR’s job faster, easier, and more accurate.

As an insurance automation consultant, I’ve seen firsthand how important database table structures are. They determine whether your system can be single-entry, whether workflows can be streamlined, and how data flows between modules.

For years, when I suggested improvements to other vendors, I’d hear:

“Our table structures won’t support that.”

That’s why CP Manager was blueprinted and designed from the ground up—with workflow, single-entry, and productivity baked into its DNA. Before a single line of code was written, I spent 18 months mapping out every workflow, task, and data flow. It was grueling—but necessary to avoid the limitations that have plagued every other agency management system.

Blue-printing a productivity driven system is based upon how an agency would use the system step by step, policy task by policy task (ie, Renewal, Endorsement, Cancellation, Claim, etc.), and what work the agency staff needed to stay on top of so things don't slip through their fingers.

Because CP Manager was designed as a productivity-driven system, nearly every “standard” feature had to be completely re-engineered:

The result?

Not only are agencies calling CP Manager “the most insurance-specific system they’ve ever used,” they're ecstatic with the huge drops in their workload because of the huge increase in their productivity.

The way your management system is designed quietly determines how much work your agency can realistically handle — regardless of how experienced or motivated your staff may be.

When a system is feature-driven, productivity gains depend on people working around the software. Over time, that creates friction: more steps, more windows, more mental tracking, and more reliance on individual memory to keep work moving. As volume increases, those small inefficiencies compound.

That’s when agencies begin to feel stretched even though everyone is working hard.

A workflow-driven system changes that dynamic.

When the system is designed to follow how work actually flows through an agency, productivity is no longer dependent on workarounds or hero effort.

Work-in-progress becomes visible.

Tasks stay connected.

Processes feel more natural instead of forced.

The result isn’t just speed — it’s the amount of work each CSR can handle each day.

Agencies gain the ability to handle more business without automatically adding staff, increasing stress, or losing control over daily operations. Decisions about hiring, growth, and service become intentional instead of reactive.

This distinction matters because productivity ceilings don’t announce themselves.

They show up as pressure, backlog, and the sense that “we’re busy, but not getting ahead.”

Understanding whether your system is helping or quietly limiting your agency is the first step toward changing that.

Over the past 40 years, numerous vendors have said they were the next evolution in agency management systems. What constitutes being a "new evolution"?

Changing the programming environment from DOS to windows? Windows to browser-based?

No, those are just changing the environment they operate under. Their layout, structure and how you do your work stayed the same.

The last time there was a major change, a new evolution in agency management systems was in the 1980's when they went from being accounting based to being client-policy driven.

That is until now with CP Manager going from feature-driven to being workflow-driven.

With CP Manager, agencies are reporting faster processing, far less double entry, and smoother daily operations. The system is still feature-rich to support workflows and increasing your productivity. More importantly, it’s built to make agencies more productive and profitable.

Don’t settle for another feature-driven agency management system that slows your staff down. Experience the first productivity driven agency management system and see the difference for yourself.

Running an insurance agency today means balancing hundreds of moving parts — client communication, policy servicing, renewals, downloads, commissions, accounting, compliance, and new business development. Without the right system in place, staff spend more time wrestling with paperwork and outdated tools than actually serving clients.

That’s where Insurance Automation Systems come in, also called "agency management systems".

Unlike generic CRM platforms, which are designed for any business, insurance automation systems are built specifically for insurance agencies. They combine client, policy, carrier, and accounting management into one single-entry platform that automates time-consuming workflows — so your team can focus on productivity and client relationships, not busywork.

Most insurance automation systems fall into one of two categories:

1. Contact-Based Systems

2. Policy-Based Systems

Modern agencies overwhelmingly prefer contact-based insurance automation systems because they give a 360° client view and reduce duplicate work.

The real value of insurance automation systems comes down to three things: specificity, totality, and productivity.

These systems are designed specifically for the insurance industry — not retrofitted CRMs. That means workflows for endorsements, renewals, certificates, accounting, and downloads are built in from day one. Implementation is faster, adoption is easier, and your staff won’t have to “make do” with tools that were never meant for insurance.

Insurance automation systems bring everything into one platform:

Instead of juggling multiple software programs, you gain one streamlined system designed for your entire agency.

The ultimate goal is efficiency. The purpose of insurance automation systems is:

Every extra click, every lost document, and every duplicate entry adds up. By automating these processes, you save hours every week — hours that go directly back into client service and revenue growth.

At the end of the day, the question isn’t whether you can afford an insurance automation system — it’s whether you can afford not to have one.

On the other hand, agencies with the right automation system see productivity soar, profits rise, and client satisfaction increase — all while reducing stress across the team.

So, how do insurance automation systems work? They work by taking everything that slows your staff down — duplicate entry, disjointed tools, manual follow-ups — and automating it in a system built specifically for agencies.

The result: a more productive staff, happier clients, and a more profitable agency.

If you’re ready to see what the right automation system could do for your agency, explore CP Manager — designed by insurance automation consultants with over 30 years of experience helping agencies increase productivity and profits.

YouTube isn’t just for big brands or influencers — it can be a smart, cost-effective way for insurance agencies to attract and educate prospects. But here’s the big question: should your agency invest the time into YouTube? Is this a good agency marketing strategy?

The answer depends on whether you’re ready to create content that connects with prospects and have the right processes in place to follow up on the leads it generates.

The agencies that win on YouTube aren’t necessarily the ones with the best equipment or biggest marketing budgets. They’re the ones who:

If you can commit to showing up with valuable content regularly, YouTube can become a steady source of inbound interest.

While content is the key, systems like CP Manager help you make the most of your YouTube success and agency marketing by:

If your agency is committed to creating consistent, helpful video content, then YouTube can absolutely be worth it. And while video content attracts leads, CP Manager ensures those leads are captured, tracked, and worked effectively — turning YouTube (and all of your other agency marketing strategies) into a true growth engine for your agency.

Next Step: Ready to see how CP Manager supports your marketing efforts — YouTube and beyond?

For many small independent agencies, the idea of an agency management system (AMS) can feel out of reach. Maybe you’ve heard that these systems are too expensive, too complex, or are only necessary for large agencies.

But the reality is that the right management system can be a game-changer for even the smallest shops — helping one or two staff handle the workload of a much larger team.

So, will management systems work for small agencies?

The answer is yes — if you choose the right one.

In small agencies, the same person often wears many hats — selling insurance, servicing clients, processing renewals, handling claims, and even balancing the books. Without the right tools, it’s easy to get bogged down by:

... All while still trying to sell new policies.

A well-designed agency management system takes these challenges off your plate so you can spend more time growing your book of business and serving clients.

The last thing a small agency wants to do is use their limited revenue to hire a CSR when the money just isn't there. While the idea of having a CSR on their team is exciting so they can stay focused on selling more policies, often they just don't have the money to hire one.

When you’re small, every new hire is a big expense, and your revenue coming in controls so many of your decisions.

The right AMS lets one CSR handle far more clients and policies with less stress than having no system at all.

Or if you're a one-man operation it allows you to grow far bigger before needing to bring on your first CSR. This gives small agencies the ability to grow bigger before needing to add staff. That means lower overhead and higher profitability.

Renewals, endorsements, invoices, certificates, servicing clients, and client emails take up huge amounts of time when done manually. A management system automates these routine tasks, keeps everything organized in one place, and ensures nothing slips through the cracks. The result: fewer errors and more time to focus on clients.

Accounting is often the toughest back-office burden for small agencies. A management system handles commission tracking, trust deposits, return premiums, and operating transfers so you can keep finances clean without needing a dedicated bookkeeper.

Yes — a agency management system absolutely works for small agencies. In fact, the productivity gains are often more dramatic because small agencies don’t have extra staff to absorb inefficiencies. The right management system allows one or two people to handle the workload of three or four, freeing up valuable time and creating space to grow.

If you’re a small agency owner who’s wondered whether a management system is worth it, the answer is clear: the right system won’t just work for you — it will transform the way you work.